Diversified Asset Management

Asset Management Platforms

A flexible, credible and diversified asset management platform built on blockchain helps enterprises to put underlying assets on the chain, realise on-chain asset packaging, authorisation and other penetrating management, and continuously track assets through on-chain risk control to help issue asset contracts and lower the financing threshold for enterprises with weak main credit but high-quality assets.

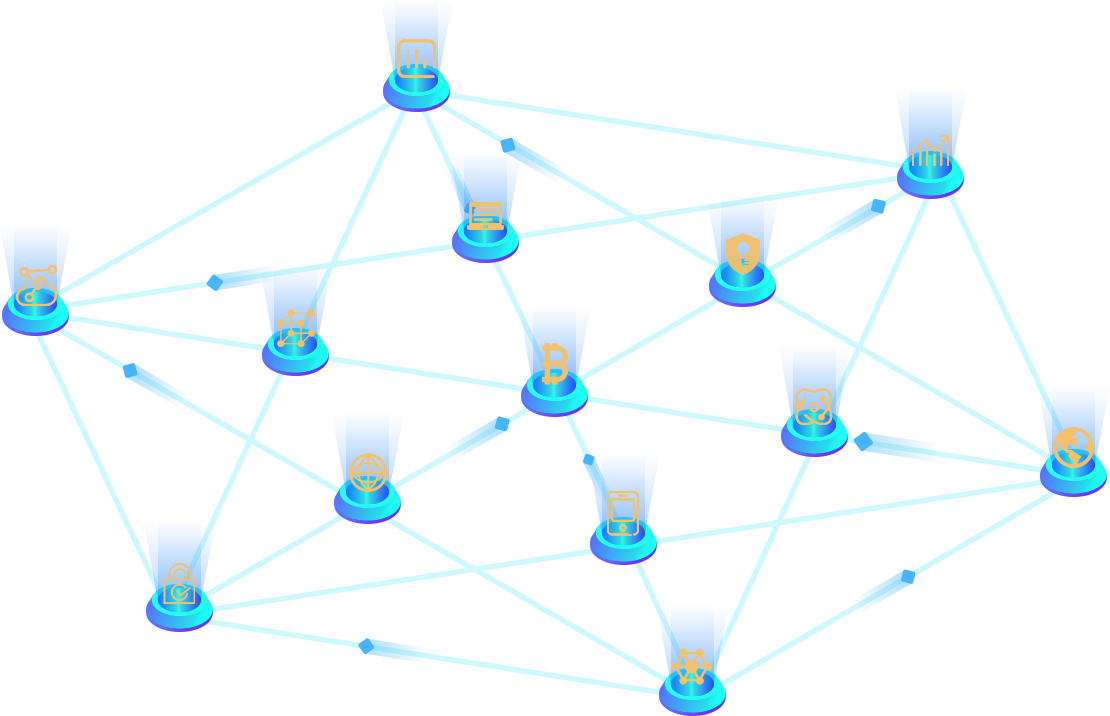

Real-time risk control analysis engine

On-chain automated asset management

This includes real-time asset on-chain storage, on-chain asset verification, automatic asset authorization, asset decision management and asset risk control analysis.

Financial-grade blockchain privacy protection

Smart contract asset management

Smart contract-based asset transaction structuring, automatic contract issuance, revolving asset purchase, and asset replacement capabilities.

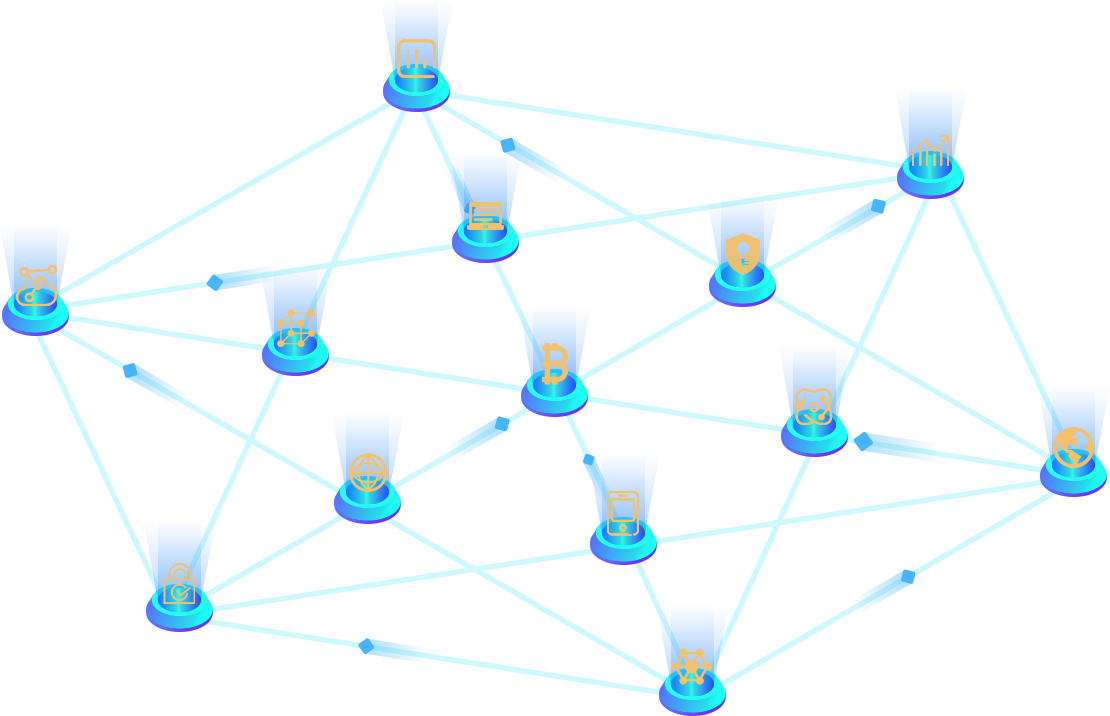

Second-level asset penetration credit boosting

Penetrating funds management

Relying on the blockchain account and verification system, enable one-stop services such as online contracting and collection and payment, help funders to see the asset formation process and help enterprises to obtain lower cost funds.

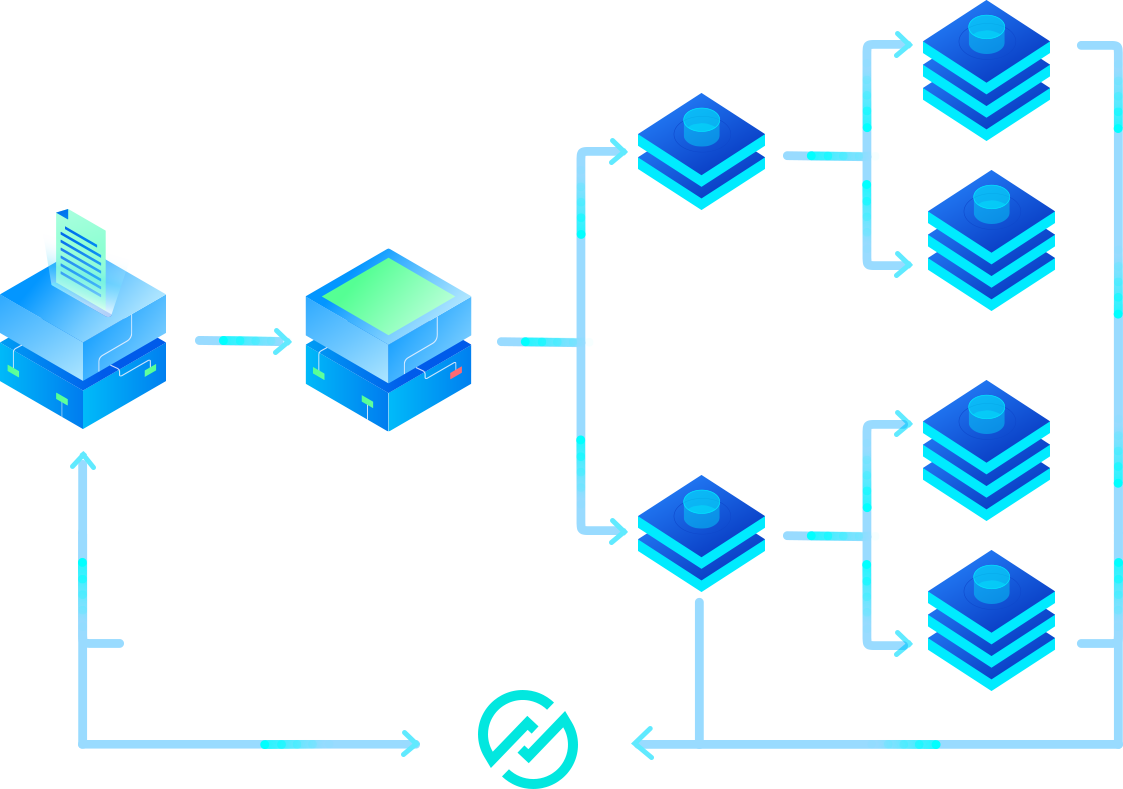

Create your blockchain project

It is applicable to asset types such as consumer finance, auto finance, equipment installment, a / R and a / P, as well as financial scenarios such as ABS, trust, transfer and pledge.